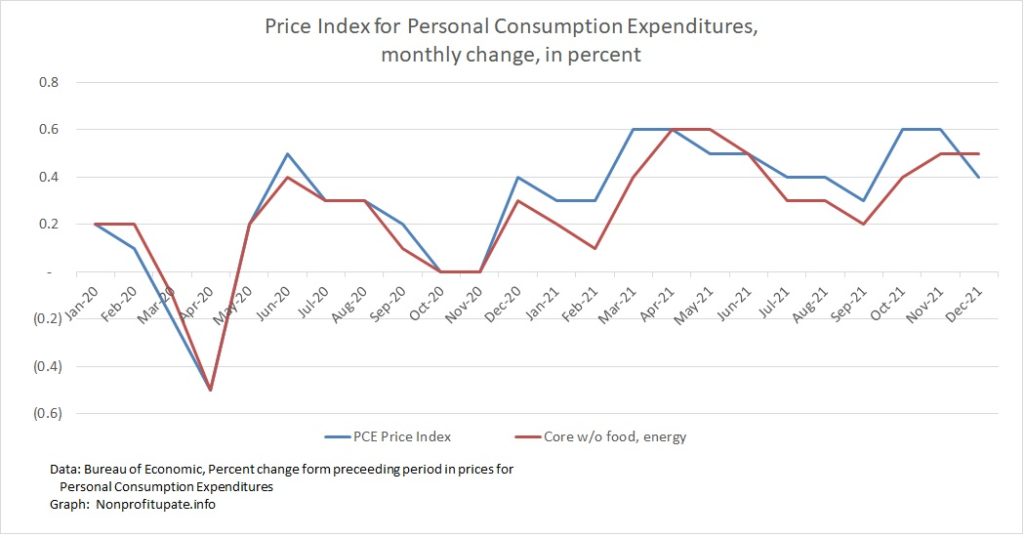

The Personal Consumption Expenditure (PCE) inflation index increased 0.4% in December 20212, which is a slight decline from 0.6% in November and 0.6% in October 2021. The December increase is in line with 0.3% to 0.5% for prior five months.

The core PCE inflation rate (without food and energy) was 0.5% in December following 0.5% November and 0.4% in October

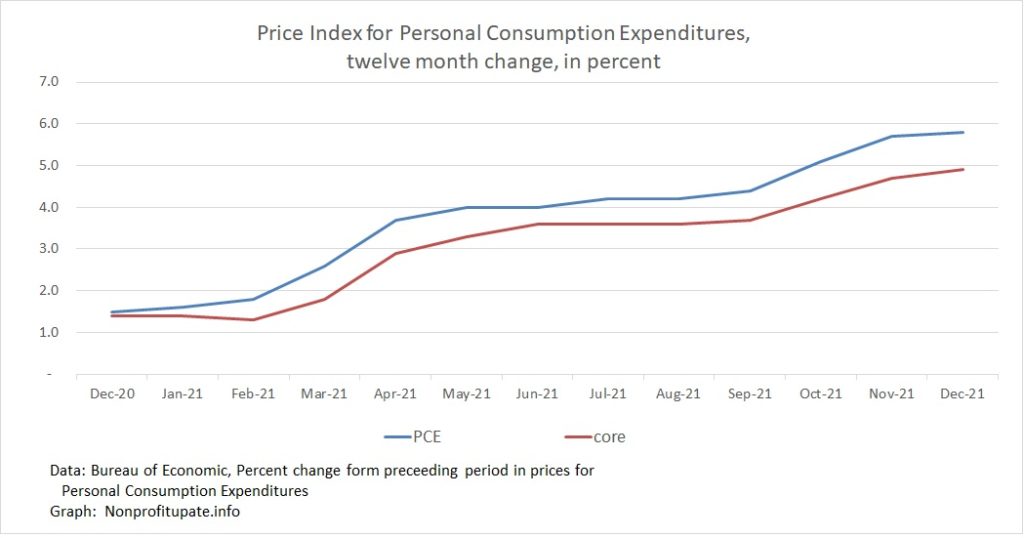

The cumulative 12-month change for 2021, according to BEA, is 5.8% overall and 4.9% excluding food and energy.

Ouch.

The PCE is the inflation index preferred by the US Federal Reserve. One aspect of the PCE compared to the CPI is the PCE numbers are routinely revised. This means prior month’s numbers will shift, sometimes by substantial amounts.

Graph at top of this post shows the monthly change in PCE, including the main index and the core index excluding food and energy.

Inflation, as measured by PCE has been high since December 2020.

The Bureau of Economic Analysis updates their calculation of the year over year change as each month’s data is revised. Their calculation of year over year inflation:

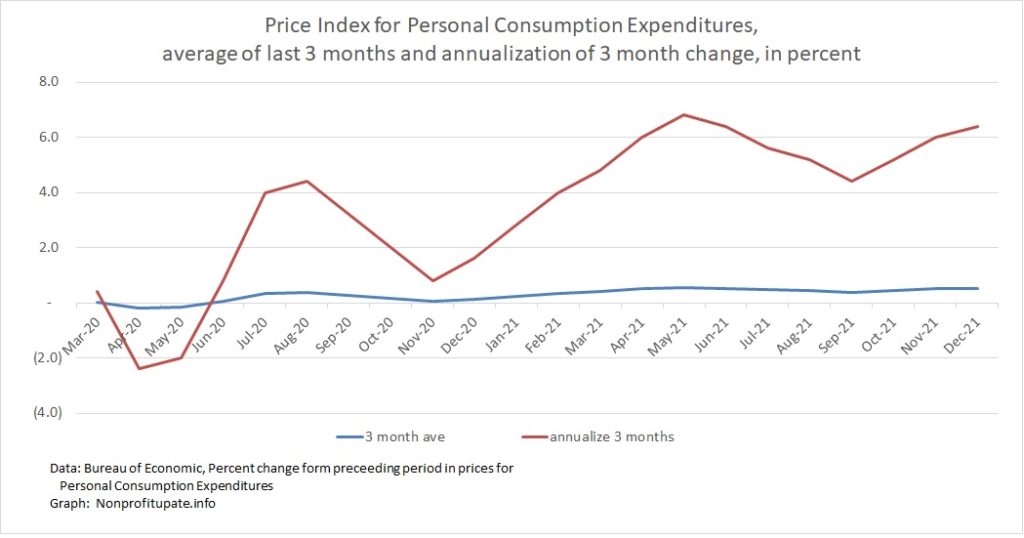

The unsettling part of the high inflation numbers since the first of the year is what happens if that rate of inflation is sustained over the course of a year. Let’s consider that unsettling idea.

Following graph shows an average of the last three months change with an annualization of the three-month average.

This shows that since March we have been above 4%. Inflation rate measured by PCE has been rising since then.

For more background on PCE, check out earlier post Monitoring inflation through the Personal Consumption Expenditure (PCE) price index.