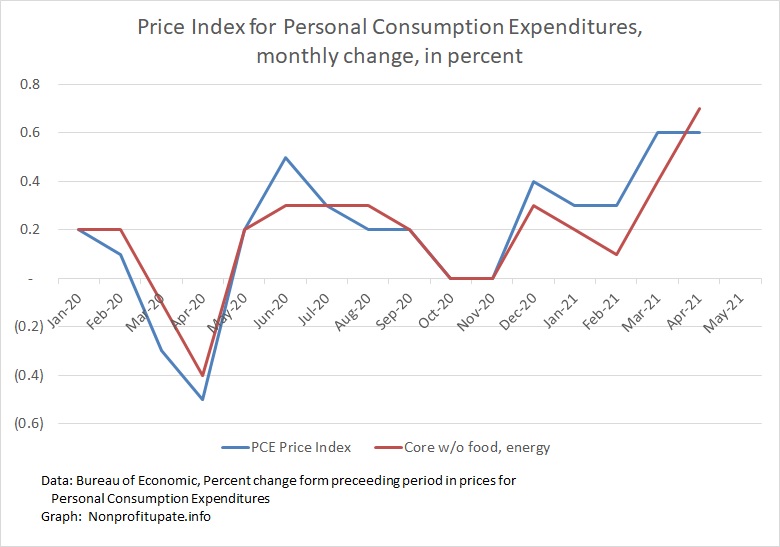

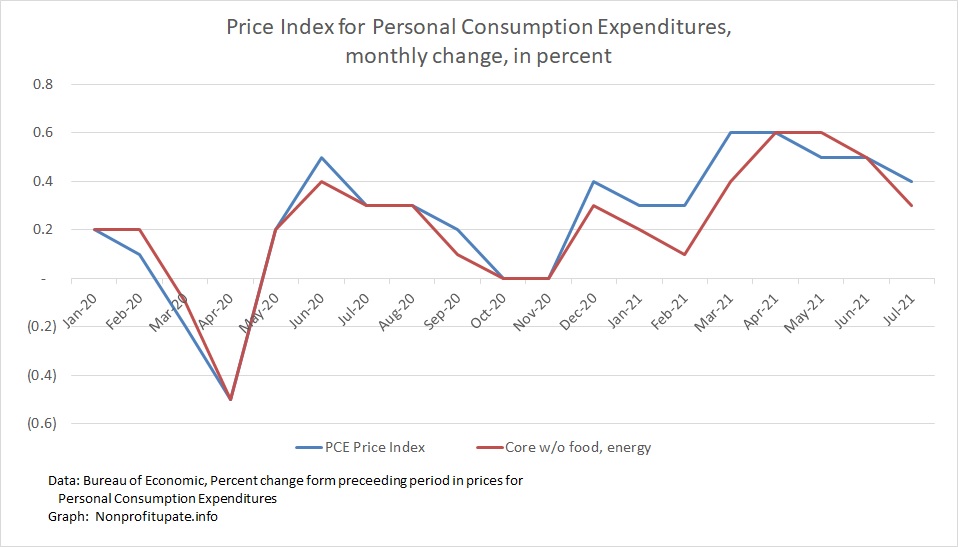

Personal Consumption Expenditure for July 2021 shows increased inflation is still in play.

The Personal Consumption Expenditure (PCE) inflation index shows an increase of 0.4% in July 2021. Since December 2020 this index is shown inflation of between 0.3% and 0.6% each month.

This indicates that inflation is continuing. Good news is that inflation is not accelerating. Bad news is an annualized inflation rate of about 6% is continuing.

The PCE is the inflation index preferred by the US Federal Reserve. An intriguing aspect of the PCE is the numbers are routinely revised. This means prior month’s numbers will shift, sometimes by substantial amounts.

Update: The year over year change in PCE is 3.6%. CNBC reports on 8/28/31 Key inflation gauge rises 3.6% from a year ago to tie biggest jump since the early 1990s. To be specific that matches the increase in May 1991 and is second only to the 4.2% increase in January 1991. Current policies of the White House and Congress have given us the highest inflation in 30 years. Not yet Carter era bad, but there is time to achieve Carter level performance.

The CNBC article also says some of the Fed members are starting to see the immediate inflation just might be more than just a temporary adjustment to the economic shutdown. President of the Atlanta Fed acknowledge such possibility when he said on-air that he is hearing from a many of his business contacts that they expect inflation go to beyond the immediate-term.

…